Users can link their Chinese bank accounts to enable seamless transactions through the Visa, MasterCard and JCB. These services are offered by verified third-party entities called "official accounts," which create mini-programs or "apps within the app" to provide specific functionalities. Users who have provided their bank account information can utilize the app for various financial transactions such as paying bills, making purchases, transferring money to other users, and even conducting in-store payments if the stores support WeChat payment. WeChat Pay reached 1.133 billion active users in 2023. Other competitors, Baidu Wallet and Sina Weibo, also launched similar features. The success prompted Alibaba to launch its own version of virtual red envelopes in its competing Laiwang service. Alibaba company founder Jack Ma considered the red envelope feature to be a " Pearl Harbor moment", as it began to erode Alipay's historic dominance in the online payments industry in China, especially in peer-to-peer money transfer. WeChat Pay's main competitor in China and the market leader in online payments is Alibaba Group's Alipay. As of March 2016, WeChat Pay had over 300 million users. WeChat Pay ( Chinese: 微信支付 pinyin: Wēixìn Zhīfù), officially referred to as Weixin Pay in China, is a mobile payment and digital wallet service by WeChat based in China that allows users to make mobile payments and online transactions. Exchange rates are based on the rates of the card organization and the issuing bank.Mobile payment service in China Weixin Pay Transaction fees are waived for payments under 200 yuan (around $28), and any amount above that charges a 3% fee.

On WeChat, spending limits per transaction, month and year for foreign visitors are 6,000 yuan (around $835), 50,000 yuan and 60,000 yuan, respectively. Visitors also can’t conduct money transfers, which is unsurprising given China’s stringent control of capital flows across borders. This feature was originally what drove WeChat’s early wave of mass adoption. Unfortunately, visitors won’t be able to try out the digitized Chinese hongbao custom, which involves sending or receiving digital versions of auspicious red envelopes filled with money.

#Android launch wechat payment verification#

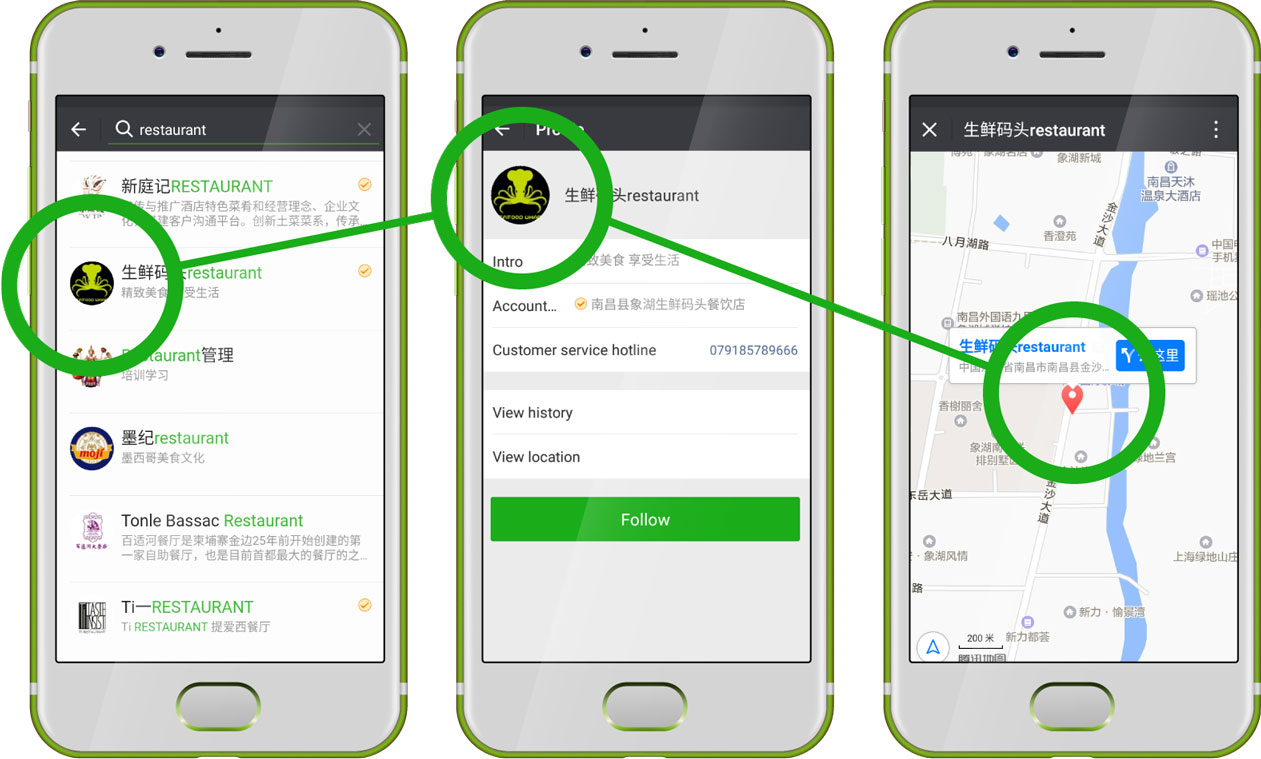

Foreign phone numbers can be used for receiving verification codes. To activate their WeChat wallets, foreign users will need to authenticate their identity by uploading their passports. WeChat’s announcement provides useful details on what the setup looks like.

#Android launch wechat payment Offline#

Given Alipay and WeChat Pay are literally ubiquitous in both China’s online and offline retail spheres, foreign visitors may now be able to hail a Didi car, ride the subway, rent a shared bike, buy fruit from a grocer, order food delivery and even shop online for myriad Chinese e-commerce goods. The development is thus a huge improvement in foreign visitors’ experience in China. While paying has become breezier for those living in China, finding places that accept cash is now a headache for foreign visitors, as the two payments giants have largely replaced cash from metropoles to villages despite the government’s efforts to warn merchants against rejecting cash. Previously, using WeChat Pay and Alipay in China required a local bank account, making it challenging for short-term visitors to use these payment methods. This week, China’s two dominant mobile payment solutions, WeChat Pay and Alipay, announced that foreign users can now pay at Chinese retailers by linking their foreign credit cards, including Visa, Mastercard and Discover. Great news for those traveling to China! You can finally enjoy the seamless, cashless payment experience that you may have heard about for years and avoid the awkward interaction of asking your local friends to pay and giving them paper money that they can’t spend anywhere.

0 kommentar(er)

0 kommentar(er)